CRE Securitized Debt Update

February 10, 2026

Private-Label CMBS and CRE CLOs

Seven transactions totaling $7.5 billion priced last week:

- BX 2026-CSMO, a $3.1 billion SASB backed by a floating-rate, five-year loan (at full extension) for Blackstone (80% ownership) and Stonepeak (20%) to refinance the 3,032-room Cosmopolitan Las Vegas Resort & Casino.

- ACORE 2026-FL1, a $1.1 billion CRE CLO sponsored by ACORE. The managed transaction comprises 22 loans secured by 45 properties. The pool’s top-three property types are multifamily (57.9%), industrial (14.8%), and retail (8.9%).

- BANK5 2026-5YR20, a $962 million conduit backed by 37 five-year loans secured by 263 properties across 43 states and Puerto Rico from BofA, JPMorgan, Morgan Stanley, and Wells.

- LBTY 2026-225L, an $800 million SASB backed by a fixed-rate, five-year loan for Brookfield to refinance the 2.4 million square foot office building at 225 Liberty Street in Manhattan.

- SPGN 2026-TFLM, a $615 million SASB backed by a floating-rate, five-year loan (at full extension) for Simon Property Group and Nuveen to refinance The Florida Mall in Orlando.

- CRSNT 2026-MOON, a $596 million SASB backed by a floating-rate, five-year loan (at full extension) for Crescent Real Estate to refinance The Crescent, a 1.4 million square foot mixed-use office and retail center in Dallas.

- BX 2026-CART, a $331.2 million SASB backed by a floating-rate, five-year loan (at full extension) for Blackstone to finance its purchase of 16 retail properties in Texas.

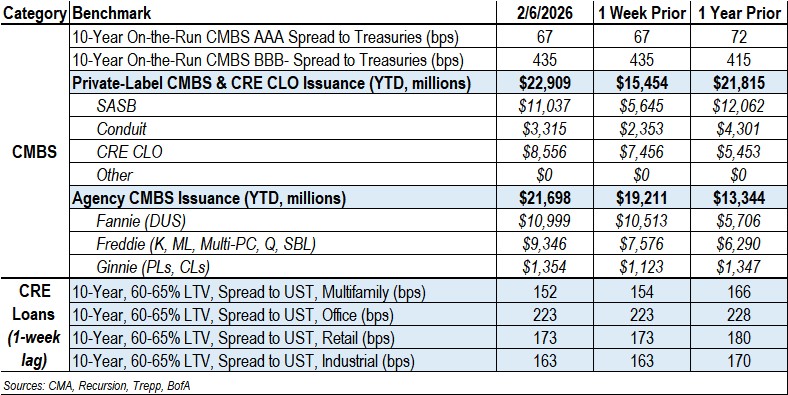

By the numbers: YTD 2026 private-label CMBS and CRE CLO issuance totaled $22.9 billion, representing a 5% increase from the $21.8 billion recorded for same-period 2025.

Spreads Hold Steady

- Conduit AAA and A-S spreads were unchanged at +67 and +100, respectively.

- Conduit AA and A spreads were unchanged at +125 and +175, respectively.

- Conduit BBB- spreads were unchanged at +435.

- SASB AAA spreads were unchanged in a range of +100 to +135, depending on property type.

- CRE CLO AAA spreads were unchanged at +135/+140 (static/managed), while BBB- spreads were unchanged at +275/+285 (static/managed).

Agency CMBS

- Agency issuance totaled $2.5 billion last week, comprising $1.8 billion in Freddie Multi-PC and K transactions, $485.9 million in Fannie DUS, and $230.7 million in Ginnie Mae Project Loan transactions.

- Agency issuance for YTD 2026 totaled $21.7 billion, 63% higher than the $13.3 billion recorded for same-period 2025.

Contact Raj Aidasani (raidasani@crefc.org) with any questions.