CRE Securitized Debt Update

January 6, 2026

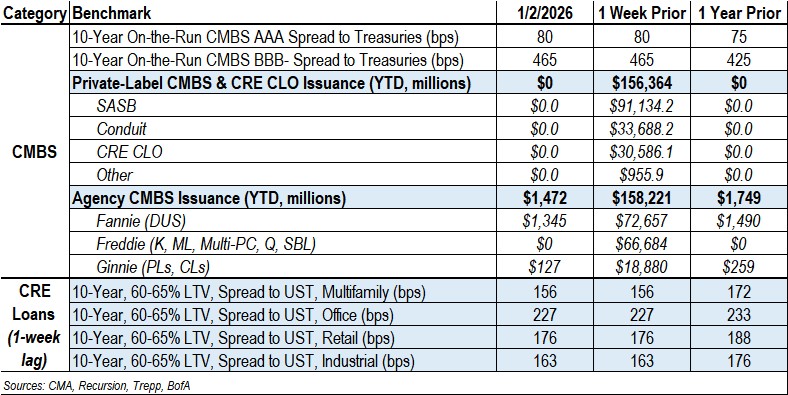

Private-Label CMBS and CRE CLOs

- As expected in a holiday-shortened week, no transactions priced.

- By the numbers: Full-year 2025 private-label CMBS and CRE CLO issuance totaled $156.4 billion, representing a 36% increase from the $114.7 billion recorded for full-year 2024.

- SASB hits a new record: The year-over-year increase in private-label issuance was helped by a record year for SASB, hitting $91.1 billion in 2025 and surpassing the previous record of $79.1 billion set in 2021.

Spreads Hold Steady

- Conduit AAA and A-S spreads were unchanged at +80 and +115.

- Conduit AA and A spreads were constant at +150 and +200.

- Conduit BBB- spreads held steady at +465.

- SASB AAA spreads remained unchanged in a range of +113 to +136, depending on property type.

- CRE CLO AAA spreads were unchanged at +135/+140 (static/managed); BBB- spreads also held constant at +340 (static/managed).

Agency CMBS

- Agency issuance totaled $1.5 billion last week, comprising $1.3 billion in Fannie DUS and $127.2 million of Ginnie transactions.

- Agency issuance for 2025 totaled $158.2 billion, 27% higher than the $124.3 billion recorded for 2024.