CRE Securitized Debt Update

January 27, 2026

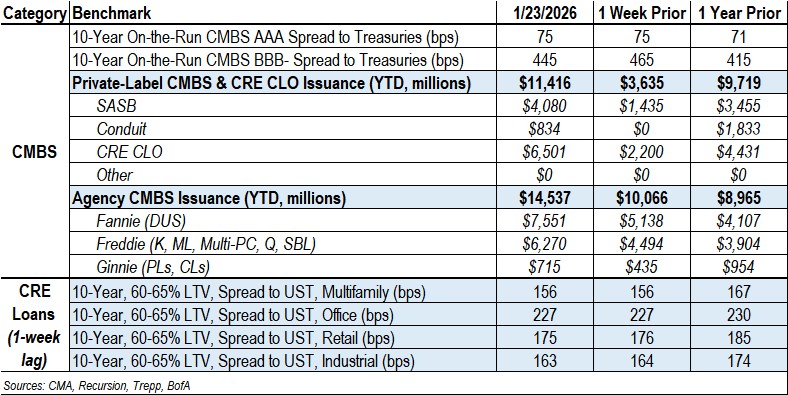

Private-Label CMBS and CRE CLOs

Eight transactions totaling $7.8 billion priced last week:

- ESA 2026-ESH2, a $1.9 billion SASB backed by a floating-rate, five-year loan (at full extension) for Blackstone and Starwood to refinance a portfolio of 196 Extended Stay America hotels.

- MF1 2026-FL21, a $1.3 billion CRE CLO sponsored by MF1 REIT III. The managed transaction comprises 24 loans secured by 35 properties. The pool’s composition is entirely multifamily.

- FSRIA 2026-FL11, a $1 billion CRE CLO sponsored by FS Credit REIT. The managed transaction comprises one whole loan and 22 loan participations secured by 32 properties. The pool’s top three property types are multifamily (32.5%), industrial (30.4%), and hotel (14.6%).

- ACRES 2026-FL4, a $1 billion CRE CLO sponsored by ACRES Commercial Realty. The managed transaction comprises 18 loan participations secured by 20 properties. The pool’s composition is entirely multifamily.

- BXMT 2026-FL6, a $1 billion CRE CLO sponsored by Blackstone Mortgage Trust. The managed transaction comprises 19 loans secured by 156 properties. The pool’s top-three property types are multifamily (69.6%), industrial (22.5%), and healthcare (4.6%).

- BBCMS 2026-5C40, an $834.4 million conduit backed by 44 five-year loans secured by 59 properties from Barclays, Argentic, Deutsche, Key, Goldman, UBS, LMF, Citi, SocGen, and Natixis.

- NYC 2026-1PARK, a $525 million SASB backed by a floating-rate, five-year loan (at full extension) for Vornado to refinance the One Park Avenue office building in Manhattan.

- NYC 2026-7W34, a $250 million SASB backed by a fixed-rate, five-year loan for Vornado and Korea Post to refinance the 7 West 34th Street office building in Manhattan.

By the numbers: YTD 2026 private-label CMBS and CRE CLO issuance totals $11.4 billion, representing a 17% increase from the $9.7 billion recorded for same-period 2025.

Spreads Tighten

- Conduit AAA were unchanged at +75, while A-S spreads tightened by 5 bps to +105.

- Conduit AA and A spreads were tighter by 15 bps to +135 and +185, respectively.

- Conduit BBB- spreads were tighter by 20 bps to +445.

- SASB AAA spreads moved by -2 bps to +1 bp to a range of +102 to +135, depending on property type.

- CRE CLO AAA spreads were unchanged at +135/+140 (static/managed); Static BBB- spreads were tighter by 65 bps to +275, and managed BBB- spreads were tighter by 55 bps to +285.

Agency CMBS

- Agency issuance totaled $4.5 billion last week, comprising $2.4 billion in Fannie DUS, $1.8 billion in Freddie K, SB, and Multi-PC transactions, and $280.5 million in Ginnie transactions.

- YTD agency issuance totaled $14.5 billion, 62% higher than the $9 billion recorded for same-period 2025.

Contact Raj Aidasani (raidasani@crefc.org) with any questions.