CRE Securitized Debt Update

December 16, 2025

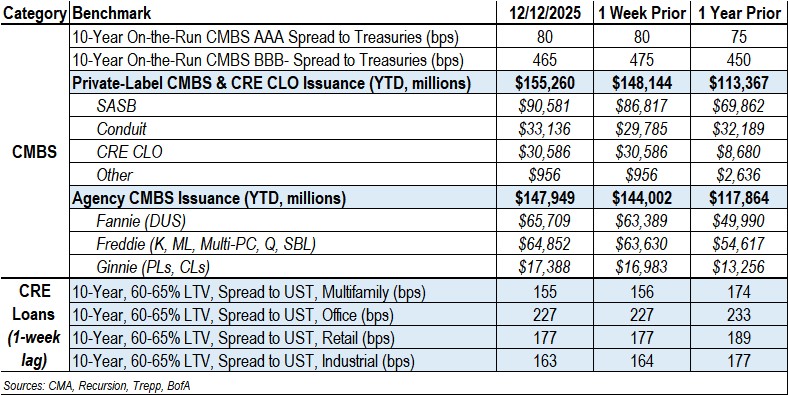

Private-Label CMBS and CRE CLOs

Eight transactions totaling $7.1 billion priced last week:

- BX 2025-ARIA, a $2.9 billion SASB backed by a fixed-rate, five-year loan for Blackstone to refinance the Aria Resort & Casino and the Vdara Hotel & Spa in Las Vegas.

- BANK 2025-BNK51, a $1 billion conduit backed by 74 primarily 10-year loans secured by 91 properties from Wells, Morgan Stanley, BofA, NCB, and JPMorgan.

- BANK5 2025-5YR19, a $949.1 million conduit backed by 35 five-year loans secured by 85 properties from Morgan Stanley, Wells, BofA, and JPMorgan.

- BBCMS 2025-C39, an $806.6 million conduit backed by 36 10-year loans secured by 69 properties from Barclays, Citi, Starwood, Deutsche, Wells, Goldman, Benefit Street, UBS, and Zions.

- BMARK 2025-V19, a $588.7 million conduit backed by 28 five-year loans secured by 48 properties from Citi, Goldman, Deutsche, and Barclays.

- NYC 2025-77C, a $405 million SASB backed by a fixed-rate, five-year loan for Clipper Equity to refinance the Tower 77 apartment building in the Greenpoint area of Brooklyn.

- GSJP 2025-BEDS, a $271.5 million SASB backed by a floating-rate, five-year loan (at full extension) for Kayne Anderson Real Estate and Core Spaces to refinance five student-housing properties in four states.

- BAMLL 2025-HYT, a $237.5 million SASB backed by a floating-rate, five-year loan (at full extension) for Portman Holdings to refinance the Hyatt Regency Salt Lake City hotel.

By the numbers: Year-to-date private-label CMBS and CRE CLO issuance totals $155.3 billion, representing a 37% increase from the $113.4 billion recorded for same-period 2024.

Spreads Come In

- Conduit AAA and A-S spreads were unchanged at +80 and +115. YTD, they are wider by 5 bps and 10 bps, respectively.

- Conduit AA and A spreads tightened by 10 bps to +150 and +200. YTD, they are wider by 15 bps and 35 bps, respectively.

- Conduit BBB- spreads were tighter by 10 bps to +465. YTD, they are wider by 40 bps.

- SASB AAA spreads moved -4 bps to +1 bp, depending on property type, to a range of +113 to +136.

- CRE CLO AAA spreads were unchanged at +135/+140 (static/managed); BBB- spreads also held constant at +340 (static/managed).

Agency CMBS

- Agency issuance totaled $3.9 billion last week, comprising $2.3 billion in Fannie DUS, $1.2 billion in Freddie K, Q, and Multi-PC transactions, and $404.7 million in Ginnie transactions.

- Agency issuance for the year totaled $147.9 billion, 26% higher than the $117.9 billion for same-period 2024.

Contact Raj Aidasani (raidasani@crefc.org) with any questions.