CRE Securitized Debt Update

November 4, 2025

Private-Label CMBS and CRE CLOs

Two transactions totaling $1.1 billion priced last week:

- MSBAM 2025-5C2, A $713.6 million conduit backed by 36 five-year loans secured by 164 properties from Morgan Stanley, BofA, Starwood, and Key.

- SYCA 2015-WAG, a $390 million SASB backed by a fixed-rate, five-year loan for Sycamore Partners on 207 Walgreens stores across 42 states and Puerto Rico. The properties were acquired in conjunction with Sycamore’s broader take-private acquisition of Walgreens Boots Alliance in late August.

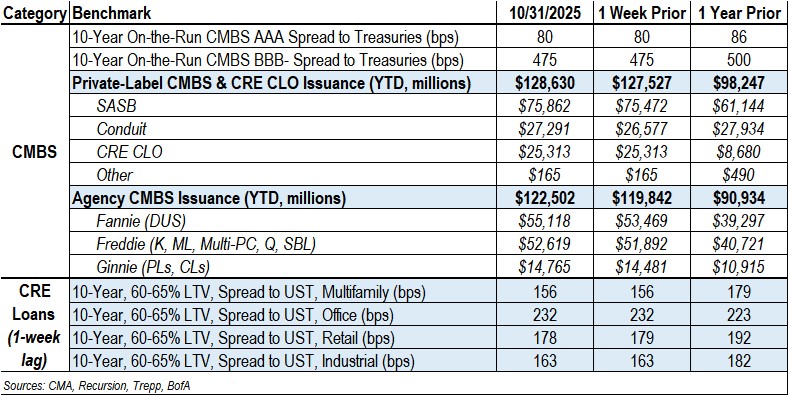

By the numbers: Year-to-date private-label CMBS and CRE CLO issuance totaled $128.6 billion, representing a 31% increase from the $98.2 billion recorded for the same period in 2024.

Spreads Hold Steady

- Conduit AAA and A-S spreads were unchanged at +80 and +115. YTD, they are wider by 5 bps and 10 bps, respectively.

- Conduit AA and A spreads were unchanged at +160 and +210. YTD, they are wider by 25 bps and 45 bps, respectively.

- Conduit BBB- spreads were unchanged at +475. YTD, they are wider by 50 bps.

- SASB AAA spreads were unchanged in a range of +113 to +137, depending on property type.

- CRE CLO AAA and BBB- spreads were unchanged at +135 and +340, respectively.

Agency CMBS

- Agency issuance totaled $2.7 billion last week, comprising $1.6 billion of Fannie DUS, a $727.7 million Freddie K transaction, and $284.1 million of Ginnie transactions.

- Agency issuance for the year totaled $122.5 billion, 35% higher than the $90.9 billion for the same period last year.

Contact Raj Aidasani (raidasani@crefc.org) with any questions.