CRE Securitized Debt Update

November 10, 2025

Private-Label CMBS and CRE CLOs

Four transactions totaling $3.5 billion priced last week:

- BX 2025-JDI, a $1.5 billion SASB backed by a floating-rate, five-year loan (at full extension) for Blackstone to refinance 94 primarily industrial properties in seven states.

- ELP 2025-ELP, an $859 million SASB backed by a fixed-rate, five-year loan for EQT Real Estate, GIC, Blackstone, and APG to refinance a portfolio of 60 industrial properties in nine states.

- BBCMS 2025-5C38, an $834.2 million conduit backed by 41 five-year loans secured by 76 properties from Barclays, Goldman, Citi, LMF, Rialto, Deutsche, Starwood, Benefit Street, and UBS.

- A10 2025-FL6, a $350 million CRE CLO sponsored by A10. The managed transaction comprises nine whole loans and 12 participations secured by 27 properties. The pool’s top three property types are multifamily (54%), retail (27.9%), and industrial (9.6%).

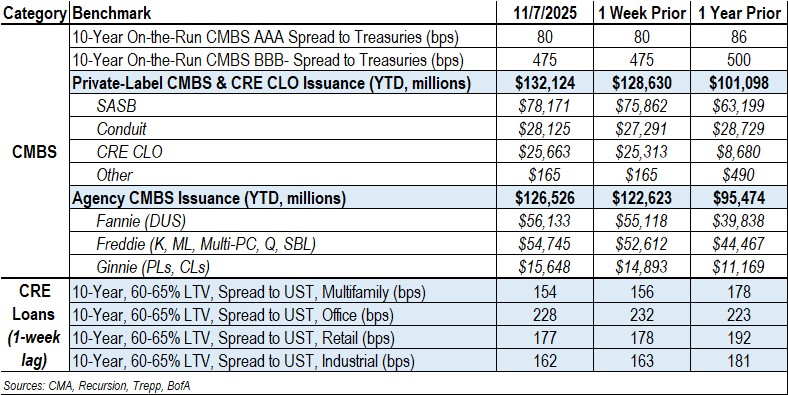

By the numbers: Year-to-date private-label CMBS and CRE CLO issuance totals $132.1 billion, a 31% increase from the $101.1 billion recorded for same-period 2024.

Spreads Hold Steady

- Conduit AAA and A-S spreads were unchanged at +80 and +115. YTD, they are wider by 5 bps and 10 bps, respectively.

- Conduit AA and A spreads were unchanged at +160 and +210. YTD, they are wider by 25 bps and 45 bps, respectively.

- Conduit BBB- spreads were unchanged at +475. YTD, they are wider by 50 bps.

- SASB AAA spreads were unchanged in a range of +113 to +137, depending on property type.

- CRE CLO AAA and BBB- spreads were unchanged at +135 and +340, respectively.

Agency CMBS

- Agency issuance totaled $3.9 billion last week, comprising $2.1 billion in Freddie Multi-PC and K transactions, $1 billion in Fannie DUS transactions, and $755.4 million in Ginnie-Mae Project Loan transactions.

- Agency issuance for the year totaled $126.5 billion, 33% higher than the $95.5 billion for the same period last year.