CRE Securitized Debt Update

October 7, 2025

Private-Label CMBS and CRE CLOs

Four transactions totaling $2 billion priced last week:

- WFCM 2025-C65, a $688.9 million conduit backed by 23 10-year loans secured by 79 properties from Wells, Argentic, JPMorgan, Goldman, SocGen, and Benefit Street.

- BSTN 2025-HUB, a $465 million SASB backed by a fixed-rate, 5.5-year loan for a BXP and Delaware North Cos. joint venture to refinance one million square feet of office and retail space within the Hub on Causeway mixed-use development in Boston.

- GSTNE 2025-HC4, a $451.6 million CRE CLO sponsored by Greystone. The managed transaction comprises 12 whole loans and seven loan participations, secured by 46 senior housing and healthcare-related properties across 13 states.

- BX 2025-OMG, a $435 million SASB backed by a floating-rate, five-year loan (at full extension) for Blackstone to refinance five multifamily properties totaling 1,717 units in Massachusetts, Florida, and Georgia.

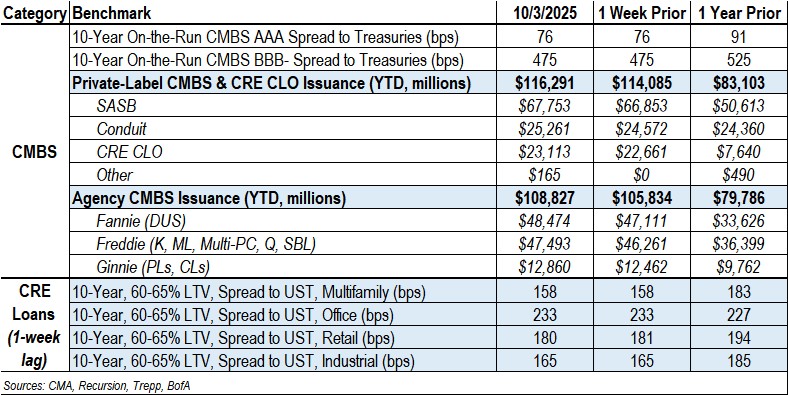

By the numbers: Year-to-date private-label CMBS and CRE CLO issuance totaled $116.3 billion, representing a 40% increase from the $83.1 billion recorded for the same period in 2024.

Spreads Largely Unchanged

- Conduit AAA spreads and A-S spreads were unchanged at +76 and +113, respectively. YTD, AAA and A-S spreads are wider by 1 bp and 8 bps, respectively.

- Conduit AA and A spreads were unchanged at +160 and +190, respectively. YTD, they are each wider by 25 bps.

- Conduit BBB- spreads were unchanged at +475. YTD, they are wider by 50 bps.

- SASB AAA spreads were wider by 3 – 5 bps to a range of +110 to +135, depending on property type.

- CRE CLO AAA and BBB- spreads were unchanged at +130 and +335, respectively.

Agency CMBS

- Agency issuance totaled $3 billion last week, comprising $1.4 billion of Fannie DUS, a $1.2 billion Freddie K transaction, and $397.9 million of Ginnie transactions.

- Agency issuance for the year totaled $108.8 billion, 36% higher than the $79.8 billion for the same period last year.