CRE Securitized Debt Update

October 28, 2025

Private-Label CMBS and CRE CLOs

Five transactions totaling $4.8 billion priced last week:

- DBC 2025-DBC, a $1.1 billion SASB backed by a floating-rate, five-year loan (at full extension) for a Related Cos. partnership to refinance 1.1 million square feet of office space within the Deutsche Bank Center at 10 and 60 Columbus Circle in Midtown Manhattan.

- LNCR 2025-CRE9, a $1.1 billion CRE CLO sponsored by LoanCore. The managed transaction comprises 11 whole loans and 11 loan participations secured by 26 properties. The pool’s top three property types are multifamily (56.1%), industrial (17.4%), and office (11.2%).

- TRTX 2025-FL7, a $1.1 billion CRE CLO sponsored by TPG. The managed transaction comprises 21 loans secured by 45 properties. The pool’s top three property types are multifamily (61.4%), industrial (23.1%), and self-storage (6.1%).

- NYC 2025-28L, a $900 million SASB backed by a fixed-rate, three-year loan for Fosun International to refinance a 2.1 million square foot office tower at 28 Liberty Street in Manhattan’s Financial District.

- CSTL 2025-GATE2, a $550 million SASB backed by a fixed-rate, five-year loan for West Shore on eight apartment complexes totaling 3,241 units in six states. The mortgage and a $50 million mezzanine loan make up a $600 million interest-only debt package that is funding the acquisition of three properties and refinancing the other five.

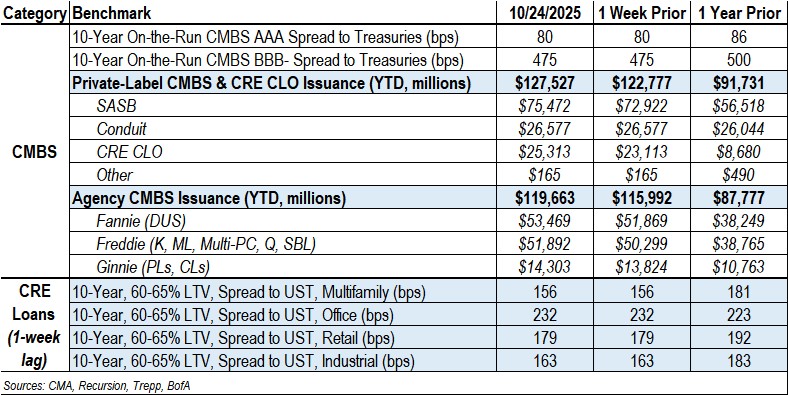

By the numbers: Year-to-date private-label CMBS and CRE CLO issuance totaled $127.5 billion, representing a 39% increase from the $91.7 billion recorded for the same period in 2024.

Spreads Hold Steady

- Conduit AAA and A-S spreads were unchanged at +80 and +115. YTD, they are wider by 5 bps and 10 bps, respectively.

- Conduit AA and A spreads were unchanged at +160 and +210. YTD, they are wider by 25 bps and 45 bps, respectively.

- Conduit BBB- spreads were unchanged at +475. YTD, they are wider by 50 bps.

- SASB AAA spreads were unchanged in a range of +113 to +137, depending on property type.

- CRE CLO AAA and BBB- spreads were unchanged at +135 and +340, respectively.

Agency CMBS

- Agency issuance totaled $3.7 billion last week, comprising $1.6 billion of Fannie DUS, $1.6 billion of Freddie K and Multi-PC transactions, and $478.8 million of Ginnie transactions.

- Agency issuance for the year totaled $119.7 billion, 36% higher than the $87.8 billion for the same period last year.

Contact Raj Aidasani (raidasani@crefc.org) with any questions.