CRE Finance World Summer 2015

12

is a banking center and together with Nashville has developed into

a southern alternative to Atlanta with less congestion and more

growth. Denver, Austin, and Portland have performed well and have

developed urban life that draws young people. San Diego is a long

time favorite destination and Indianapolis has done better than

average in drawing YCEs to its low cost environment.

Aside from the major and energy sector dependent markets, the list

favors Salt Lake City, Nashville, Denver, Austin, Orlando, San Diego,

Tampa, Portland and to a lesser extent Sacramento, Baltimore,

Buffalo, Indianapolis and Charlotte.

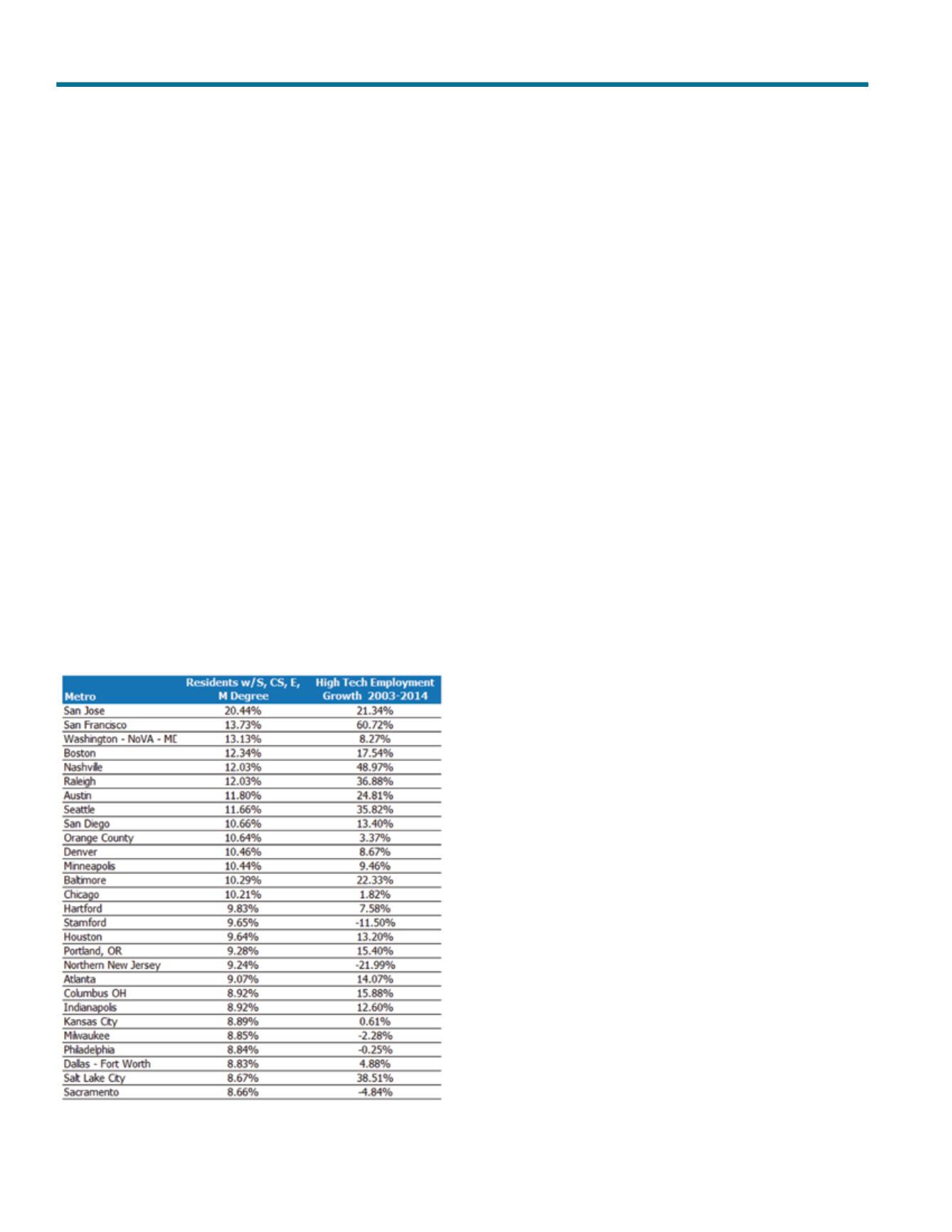

Stem Education and Hi Tech Employment Growth

High-Tech employment growth is directly correlated with the share

of residents with a Bachelor’s Degree in science, computer science

(Technology), engineering, or math (STEM)

13

. Markets with a

considerable amount of residents with STEM degrees combined

with a high growth rate of high-tech employment should portend

solid future growth. The chart below presents markets with a

strong pool of residents with a Bachelor’s Degree in STEM

14

.

Table 3

Source: U.S. Census; CoStar Portfolio Strategy

The above data concerning high-tech employment growth and

STEM education mostly favors the metros detailed in the upper

half of the charts. San Francisco, Nashville, and Salt Lake City

exhibited the strongest growth. With the exception of the major

markets, the list favors Nashville, Raleigh, Austin, Seattle, San

Diego, Denver, Salt Lake City, Minneapolis, Portland, Indianapolis,

and Columbus.

Markets with Tech Job Growth

Technology is not the largest sector of the labor force, but it

represents one of the major growth engines of overall employment.

Technology jobs constitute 5% of office-using demand in CBDs

and 8% in suburban markets, according to data from CoStar

Portfolio Strategy; however, they drive demand for other sectors

as well. Innovation technology reflects on the overall vibrancy of

the market. Consider that for 2014, net office space absorption

as a percentage of total inventory excelled in tech heavy markets

(San Jose, Seattle, San Francisco, Austin and Raleigh) (1.9% vs

1.1% for non-tech). The net absorption advantage of tech heavy

markets was even more substantial for the prior two year period

(3.5% vs 1.8% for non-tech) and the prior five year period (7.9%

vs 3.3% for non-tech). Enrico Moretti’s research indicates that for

each new high-tech job in a metropolitan area, five additional local

jobs are created

15

. The areas with strong growth rates, mostly, have

strong concentrations of high-tech office jobs. High-tech office

jobs are getting more concentrated as opposed to finance jobs

that are dispersing

16

.

The markets with the highest tech location quotients are as

expected in the San Francisco Bay area/Silicon Valley. Other

high-tech hubs include Seattle: 2.38, Boston: 1.97, Raleigh: 1.97,

Denver: 1.90 and San Diego: 1.62. Other markets with better than

average location quotients include regional economic capitals

Atlanta: 1.54, Dallas: 1.53, and Chicago: 1.09. Five of the top six

US investment markets score well

17

.

Office-Using Jobs

Office demand is driven by jobs that require office space. Office-

using jobs (OUJ) for the top 54 markets tracked by CoStar

increased 2.7% per year over the past five years and are forecast

to grow 2.1% over the next five years.

The markets that led growth patterns over the past five years where

Raleigh-Cary NC: 6.6%, Austin-Round Rock-San Marcos TX: 6.2%,

Nashville-Davidson-Murfreesboro-Franklin TN: 6.2%, San Jose-

Sunnyvale-Santa Clara CA: 5.6%, San Francisco-San Mateo-Red-

wood City CA: 5.4%, Jacksonville FL: 4.3%, Dallas-Fort Worth-

Arlington TX: 4.1%, Houston-Sugar Land-Baytown TX: 4.0%, Salt

Lake City UT: 3.9% and Miami-Miami Beach-Kendall FL: 3.9%.

Beyond The Big Six: Identifying Alternative Us Office Markets Based On Long Term Demand Generators